do closed end funds have liquidity risk

To offset the liquidity risk many of these ETFs have an open Line of credit to meet potential redemptions. Closed-end funds can be subject to liquidity problems both at the level of the fund and at the level of the shareholders Faust says.

Investing In Closed End Funds Nuveen

Since closed-end funds are less popular they have to try harder to win your affection.

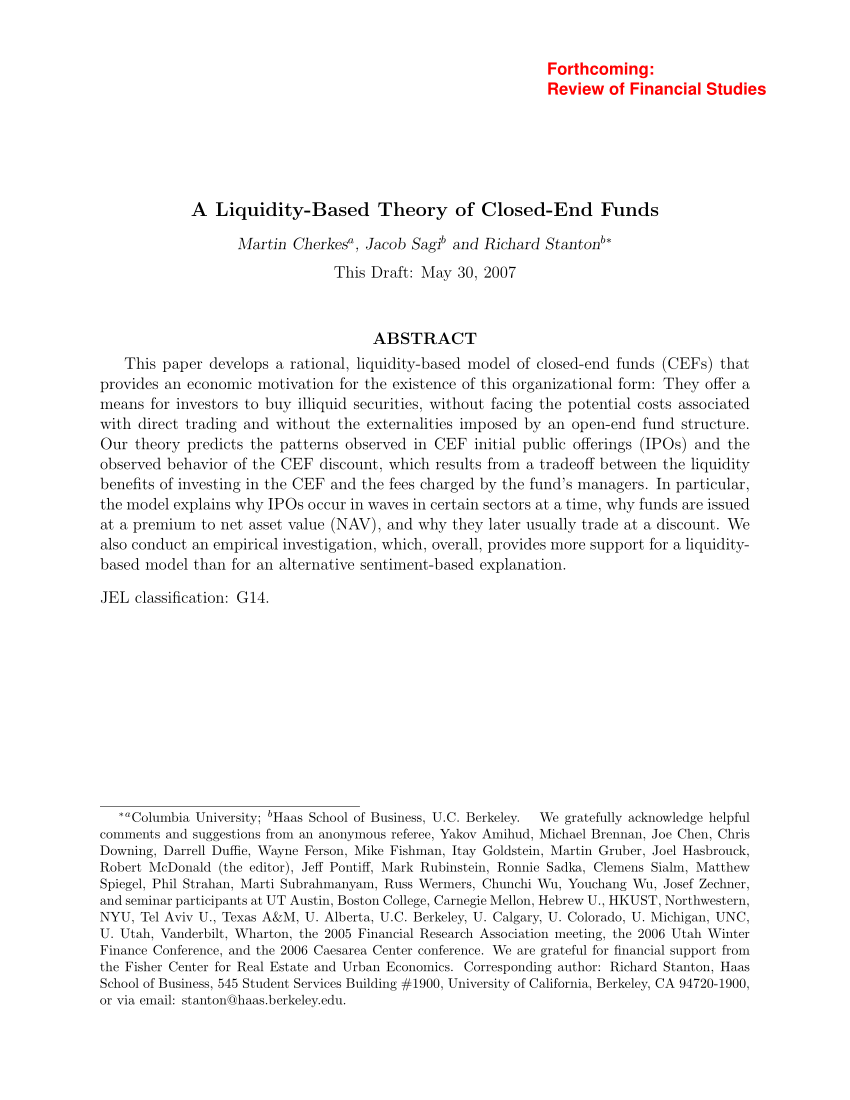

. Perhaps they should be. Their yields range from 632 on average for bond CEFs to. Additionally we find that the higher the liquidity risk of a closed-end fund relative to its underlying portfolio the larger the closed-end fund discount market price of the closed end fund is.

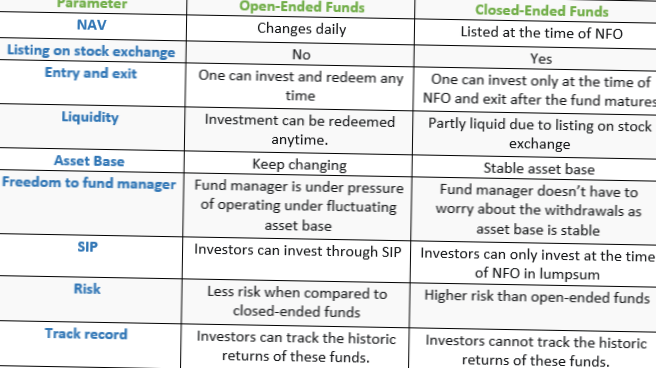

Unlike with open-end mutual funds a closed-end fund manager does not face reinvestment risk from daily share issuance. This can result in. Portfolios that invest in them may be subject to greater.

Determination of a highly liquid investment minimum. Liquidity risk within mutual funds is caused by a lack of ready cash to properly handle shareholder transactions. Regulation of the asset management industry is one of the Commissions most important.

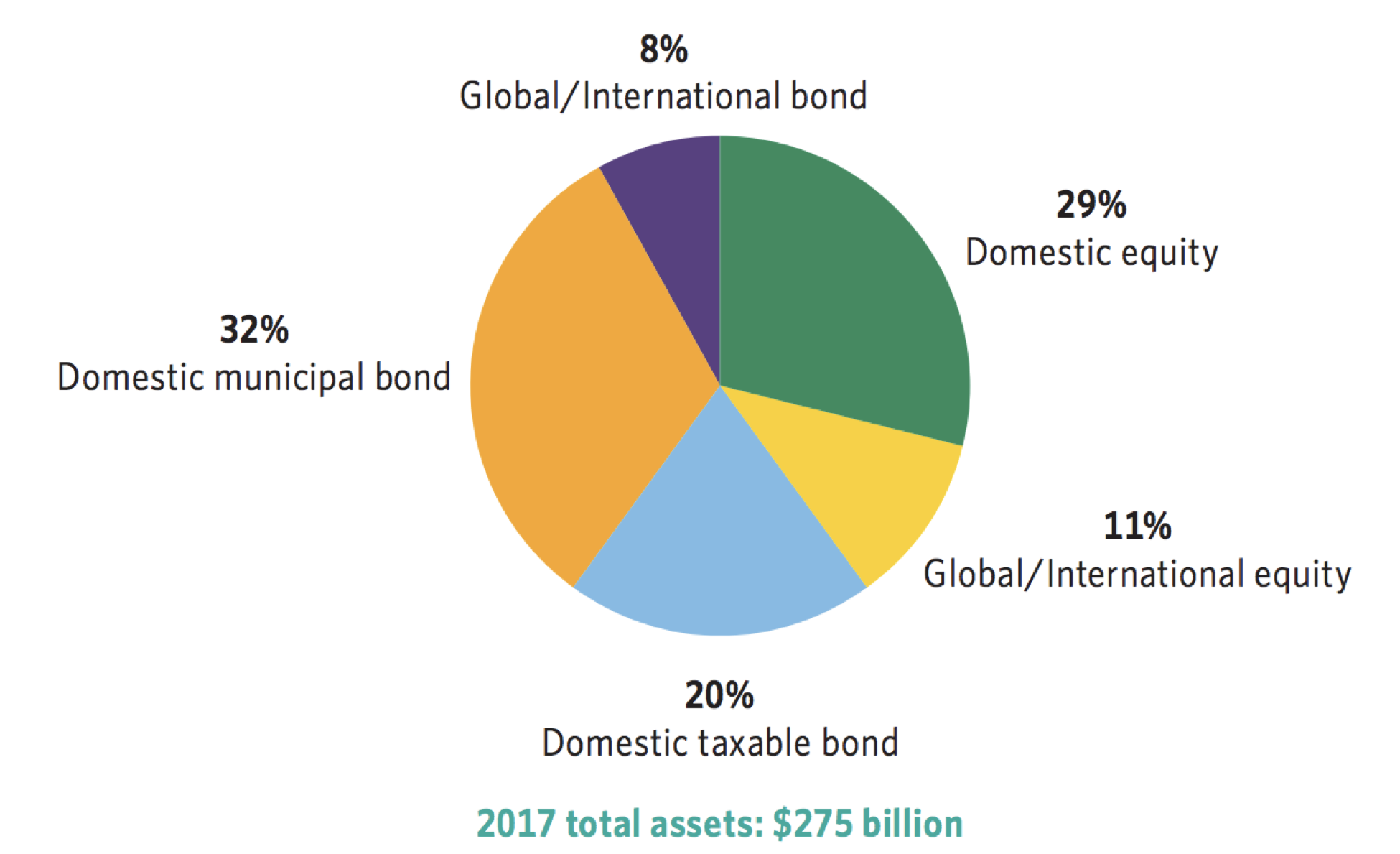

The industry offers more than 580 CEFs with assets exceeding 290 billion according to the. Because there is no need to raise cash quickly to meet unexpected redemptions the capital is considered to be more stable than in open-end funds. Always buy them at a discount.

LiquidityLow Volume higher liquidity risk exists for funds with low volumes. A closed-end fund manager does not have to hold excess cash to meet redemptions. CEFs are exposed to much of the same risk as other exchange traded products including liquidity risk on the.

These lines of credit can allow the funds to sell holdings over time limiting losses. In 1893 more than 30 years before the first open-end funds. Unlike open-end funds managers are not allowed to create new shares to meet demand from investors.

But while closed-end funds and mutual funds can invest in illiquid securities closed-end funds are not impacted by redemptions as mutual funds are and they are allowed to hold a greater percentage of illiquid securities in their investment portfolios. Youd lose almost 145000 to those higher fund fees. Over time CEFs have evolved to include a variety of asset classes and.

Funds have to stand ready at all times to process redemption requests as they come in and should have either cash on hand or securities readily able to be converted to cash. High-yield lower-rated securities involve greater risk than higher-rated securities. Five reasons to use closed-end funds.

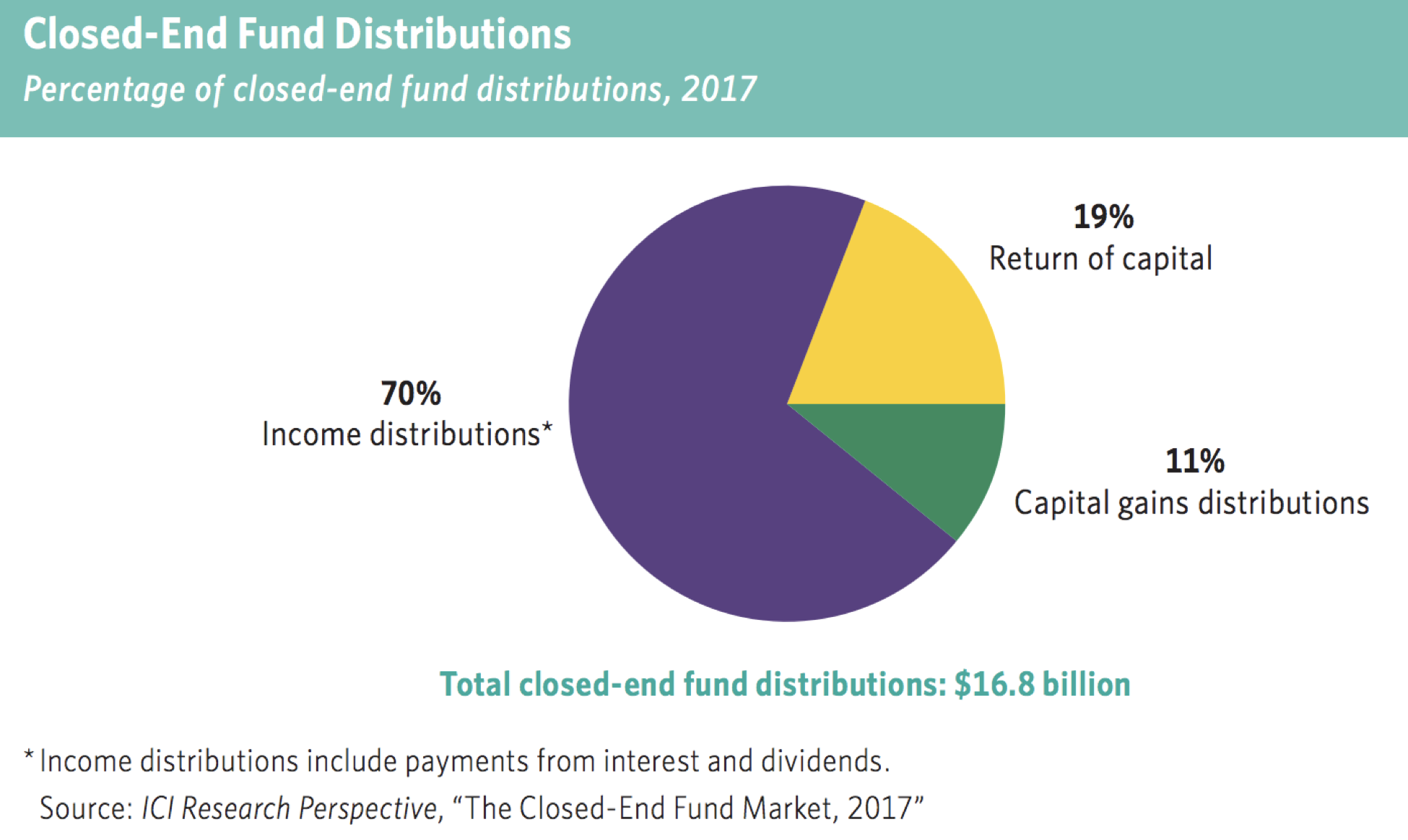

Assessment management and periodic review of a funds liquidity risk. Closed-end funds CEFs can be one solution with yields averaging 673. Closed-end funds have more regulatory flexibility than open-end funds to.

In other words it could be harder to buy and sell the stock at desirable prices depending on how many people are willing to take the other side of your trade. The Commission will consider a recommendation of the staff to propose a new rule and amendments designed to strengthen the management of liquidity risks by registered open-end investment companies including mutual funds and exchange-traded funds or ETFs. The first closed-end funds were introduced in the US.

If you invested five grand a year and got just a 6 annual return youd have over 490000 at the end of 35 years on a fund with a 08 expense ratio. If you instead paid a 23 expense ratio youd be left with just 345000 over the same period. Changes in interest rate levels can directly impact income generated by a CEF.

Unlike open-end funds closed-end funds do not need to maintain liquidity to meet daily redemptions. High-yield lower-rated securities involve greater risk than higher-rated securities. The value of a CEF can decrease due to movements in the overall financial markets.

Classification of the liquidity of fund portfolio investments. Portfolios that invest in them may be subject to greater. Yet closed-end funds CEFs are not nearly as popular as open-end mutual funds.

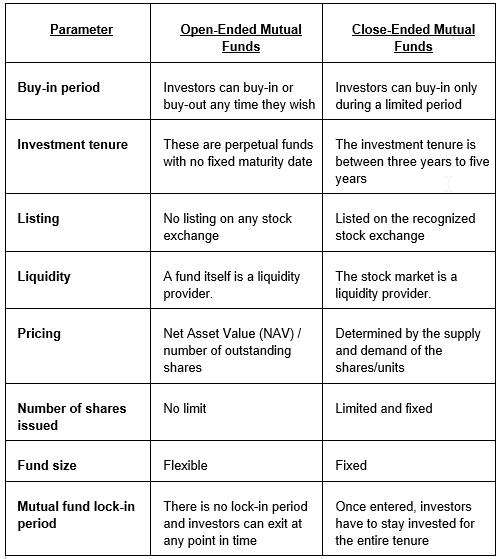

Limitation on illiquid investments. Leverage borrowing money increases risks and costs. Less liquid than open-end funds Available only through brokers May get heavily discounted Closed-End Funds and Net Asset Value NAV Its pricing is one of the unique characteristics of a closed-end.

With a closed-end fund the number of shares is fixed and shares are not redeemable from the fund. Closed end funds arent without risks either. Closed-end funds CEFs can play an important role in a diversified portfolio as they may offer investors the potential for generating capital growth and income through investment performance and distributions.

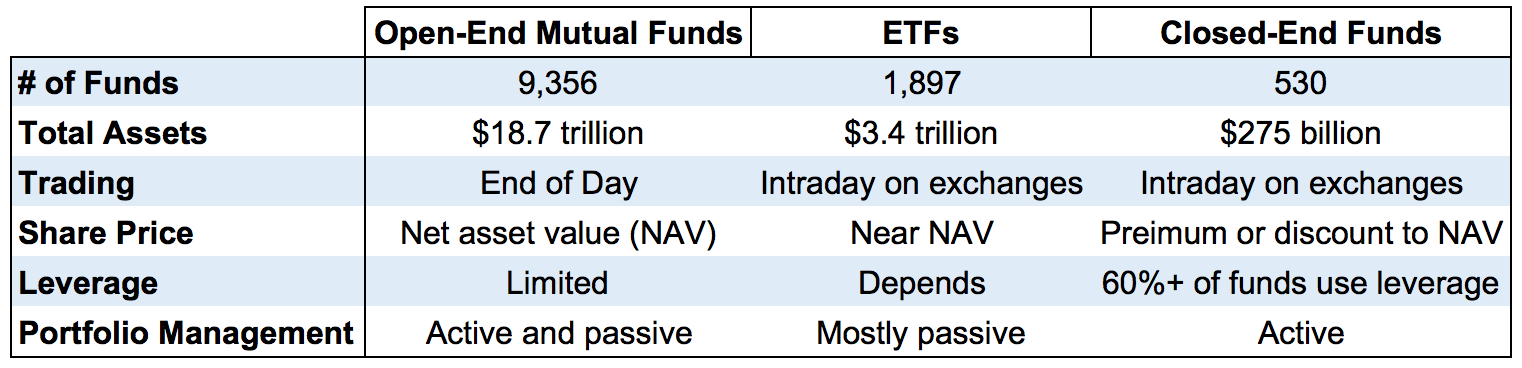

Costs the expense ratios are competitive with most open end mutual funds but still higher than index funds and ETFs. Since closed-end funds are a much smaller asset class than open-end mutual funds ETFs and stocks some of them have much less trading liquidity. Understand Where the Money Comes From.

Despite their head start closed-end funds are less popular because they tend to. Thus they have more flexibility to invest in less liquid securities. The liquidity risk management program is required to include multiple elements including.

Just like open-ended funds closed-end funds are subject to market movements and volatility. Funds or funds4 or closed-end upon which several of the Acts other provisions depend turns on whether the investment companys shareholders have the right to redeem their shares on demand. When the Investment Company Act was enacted it was understood that redeemability meant that an open-end fund had to have a liquid portfolio.

They can make a good investment potentially even better than open-end funds if you follow one simple rule. The closed-end structure Mark Northway explains provides the manager with the benefit of permanent or long-term committed capital while.

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Reassessing Investment And Liquidity Risks Kpmg Global

Pdf A Liquidity Based Theory Of Closed End Funds

Open Ended Mutual Fund Vs Close Ended Mutual Fund What To Prefer

Closed End Fund Definition Examples How It Works

What Is The Difference Between Closed And Open Ended Funds Quora

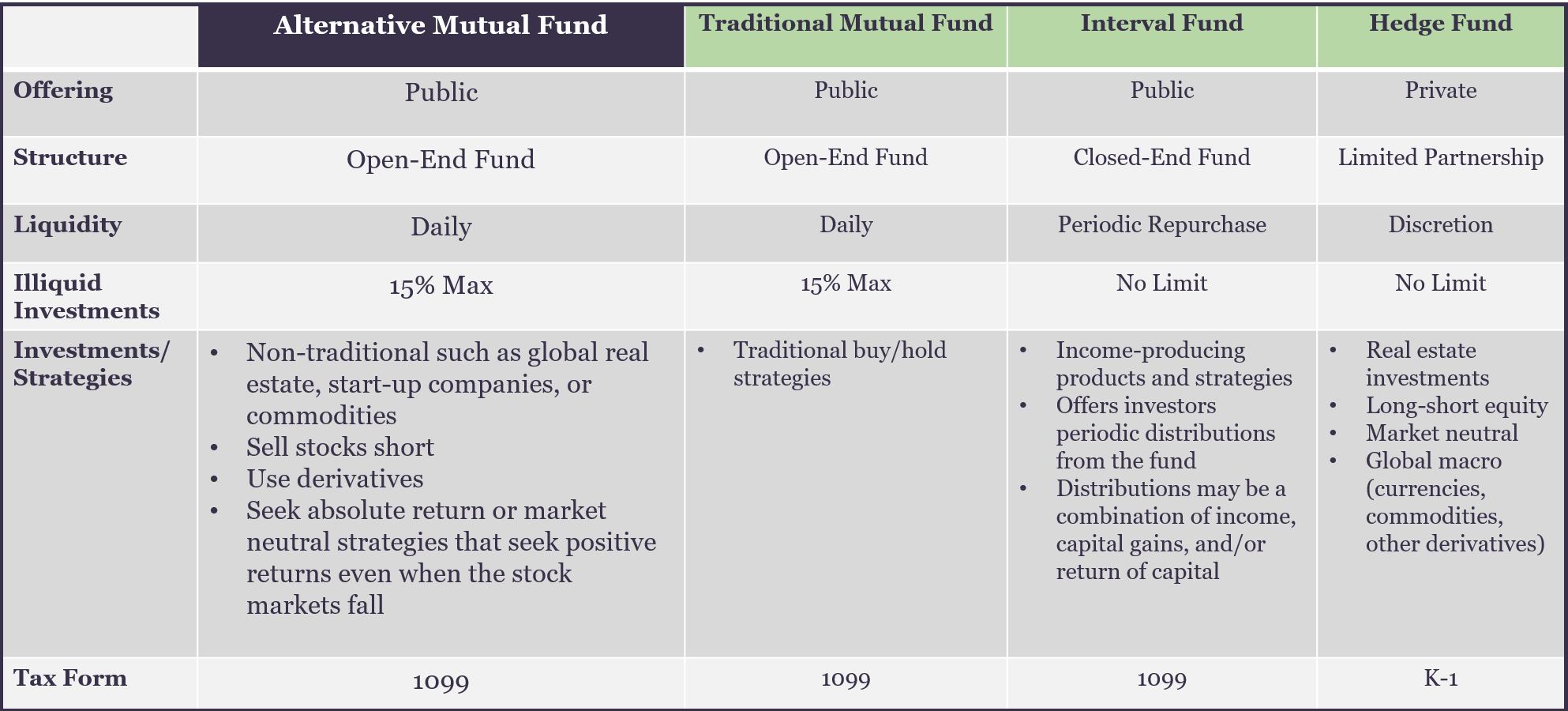

Alternative Mutual Fund Liquidity Spectrum Investment Comparison

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

What Is The Difference Between Closed And Open Ended Funds Quora

Understanding Interval Funds Griffin Capital

Pdf A Liquidity Based Theory Of Closed End Funds

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

The Problem With Open Ended Life Settlement Funds Articles Advisor Perspectives

Tourshabana What Are Closed End Vs Open End Mutual Funds Compare 4 Key Differences In Investing

Difference Between Open Ended And Closed Ended Mutual Funds Differbetween

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends