lake county sales tax rate 2021

505 Harrison Avenue. Blaine County ID Sales Tax Rate.

This Is The Most Expensive State In America According To Data Best Life

The 2018 United States Supreme Court decision in South Dakota v.

. Main Street Crown Point IN 46307 Phone. At the sale a tax buyer paysbuys the taxes then the county collector distributes the money from the sale to each of the taxing bodies to make them whole. Benewah County ID Sales Tax Rate.

State State Sales Tax Rate Rank Avg. First day to register for the Tax Year 2020 tax sale will be October 11 2021. After payment is received for the lien the Lake County Auditor issues the Tax Sale Certificate.

2021 There were no sales and use tax county rate changes effective July 1 2021. 2021 Reappraisal Fact Sheet. State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town Option and Resort taxes.

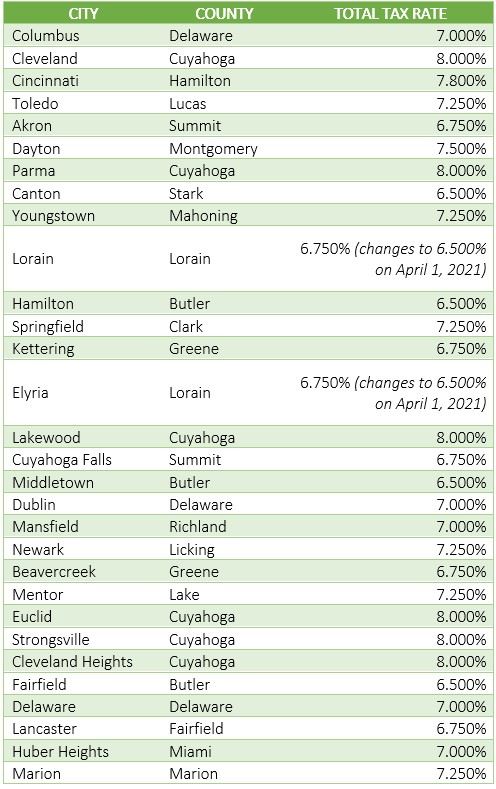

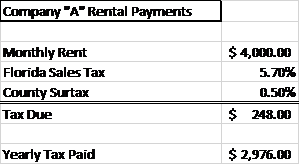

While many counties do levy a countywide sales tax Lake County does not. The states sales and use tax rate is currently 575. Automating sales tax compliance can help your.

The Lake County sales tax rate is. The average sales tax rate in Colorado is 6078. The current total local sales tax rate in Lake County IN is 7000.

Some cities and local governments in Lake County collect additional local sales taxes which can be as high as 25. Bellevue ID Sales Tax Rate. The California sales tax rate is 65 the sales.

Rates listed by city or village and Zip code. 2021 Vacant Land Sales. The Commissioners may offer the certificates at a public auction following the statutes for the tax sale.

Look up the current sales and use tax rate by address. The Lake County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Lake County local sales taxesThe local sales tax consists of a 100 county sales tax. Heres how Lake Countys maximum sales tax rate of 10 compares to other counties around.

The entire combined rate is due on all taxable transactions in that tax jurisdiction. Lake County Has No County-Level Sales Tax. Customs duties import taxes managed tariff code classification SIZE.

There was legislation to reduce the rate to 54 in 2021 but the legislation was never enacted because the economic tsunami of Covid-19 started to hit while the legislation. The Lake County Ohio sales tax is 700 consisting of 575 Ohio state sales tax and 125 Lake County local sales taxesThe local sales tax consists of a 125 county sales tax. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104.

We will be using a system named RAMS. 2nd Quarter effective April 1 2021 - June 30 2021 Rates listed by county and transit authority. Method to calculate Lake County sales tax in 2021.

The California sales tax rate is 65 the sales. The current total local sales tax rate in Lake County FL is 7000. Subject to sales and use tax and includes.

Method to calculate Lake County sales tax in 2021. 2021 Lake County Budget Order - Issued January 15 2021. As of June 18 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in compliance with California.

Some cities and local governments in Lake County collect additional local sales taxes which can be as high as 375. Has impacted many state nexus laws and sales tax collection requirements. Blackfoot ID Sales Tax Rate.

91 rows For more information on sales use taxes see Pub 25. Tax sale date for Lake County. Lake County collects a.

1788 rows California City County Sales Use Tax Rates effective April 1 2022. Method to calculate Lake County sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Bennington ID Sales Tax Rate.

The Illinois sales tax of 625 applies countywide. 2 Randomized Auction Management System which was approved by. The December 2020 total local sales tax rate was also 7000.

Bayview ID Sales Tax Rate. Bingham County ID Sales Tax Rate. All counties will have a LIT rate but not all counties have CIT or FAB taxes.

Our office is proceeding with tentative plans to hold a tax sale for delinquent 2020 taxes on December 6 2021. Groceries are exempt from the Lake County and Florida state sales taxes. The Lake County Sales Tax is collected by the merchant on all qualifying sales made within Lake County.

Local Sales Tax Rate a Combined Sales Tax Rate Rank Max Local Sales Tax Rate. Bern ID Sales Tax Rate. To review the rules in Ohio visit our state-by-state guide.

Look up 2021 sales tax rates for Lake County South Dakota. Small business solution. For several years the state reduced the commercial rental sales tax rate small amounts with the latest reduction to 55 plus the local surtax effective January 1 2020.

A county-wide sales tax rate of 025 is applicable to localities in Lake County in addition to the 6 California sales tax. The Lake County Sales Tax is collected by the merchant on all qualifying sales made within Lake County. For redemption information or information on assuming title please contact the Lake County Auditors Office at 219 755-3155 link to Auditor.

Lake 100 050 725 Wood 100 675 Lawrence 150 725 Wyandot 150 725 Note. Tax rates provided by Avalara are updated monthly. Bear Lake County ID Sales Tax Rate.

If taxes are not redeemed in 2 years vacant property or 25. After the sale is completed the homeowner of record deals directly with the Lake County Clerks Office for the redemption. Look up 2021 sales tax rates for Lake County South Dakota.

Groceries are exempt from the Lake County and Ohio state sales taxes. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The Ohio state sales tax rate is currently.

The sales and use tax rate for Lucas County 48 will increase from 725 to 775 effective April 1 2022. The Lake County Sales Tax is 025. Lake County Assessors Office.

Building A 2nd Floor 2293 N. As of January 1 2021.

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Ohio Sales Tax Guide For Businesses

How To Calculate Sales Tax Definition Formula Example

California Sales Tax Rates By City County 2022

Florida Sales Tax Information Sales Tax Rates And Deadlines

Alabama Sales Tax Rates By City County 2022

Kansas Sales Tax Rates By City County 2022

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Arizona Sales Tax Rates By City County 2022

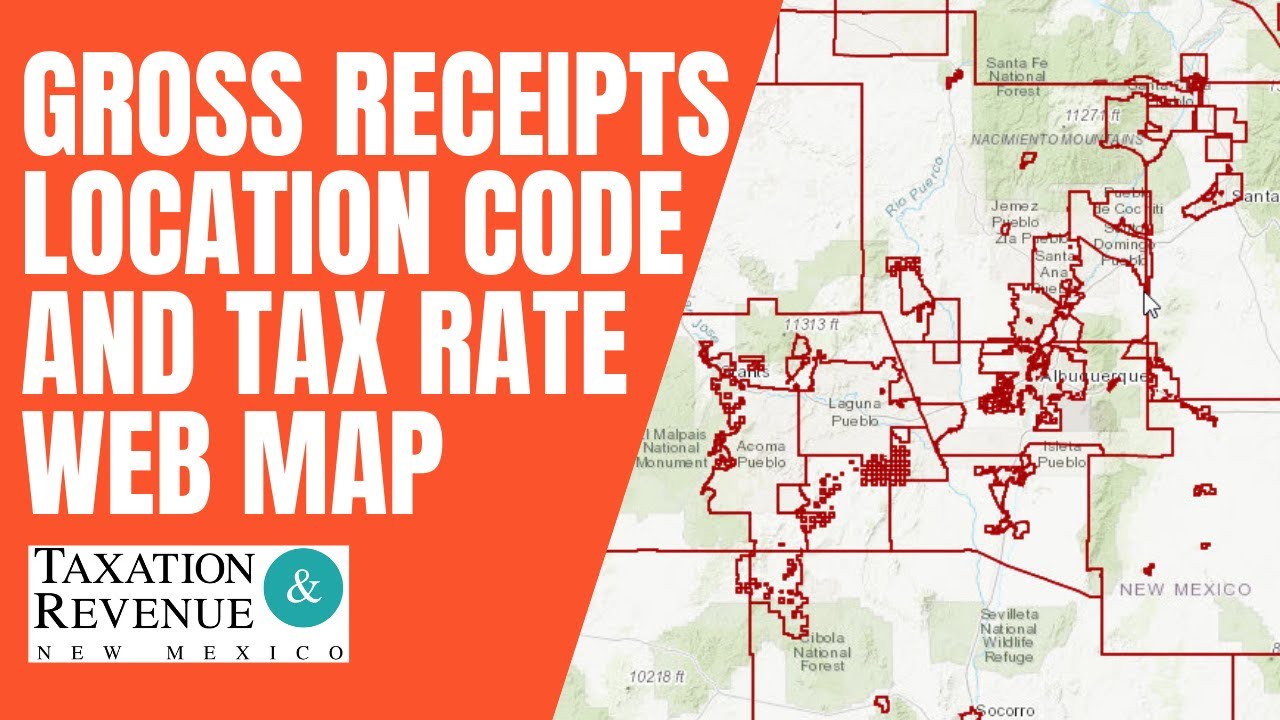

Gross Receipts Location Code And Tax Rate Map Governments

How To Calculate Fl Sales Tax On Rent

Nevada Sales Tax Rates By City County 2022

Louisiana Sales Tax Small Business Guide Truic

Sales Tax In Orange County Enjoy Oc

2021 Florida Sales Tax Rates For Commercial Tenants Winderweedle Haines Ward Woodman P A